Updating life expectancy assumptions for the new CMI 2020 model

Updating life expectancy assumptions for the new CMI 2020 model

31 Mar 2021

At a glance

The latest mortality projections model has recently been released: CMI 2020. Employers usually update their accounting numbers for these models each year

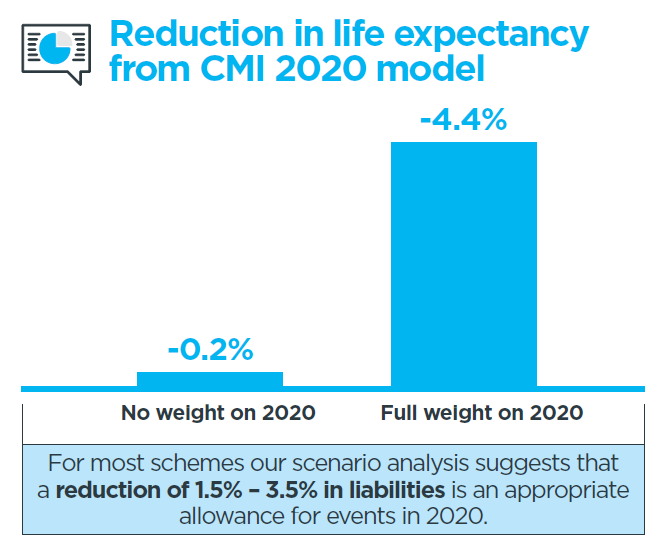

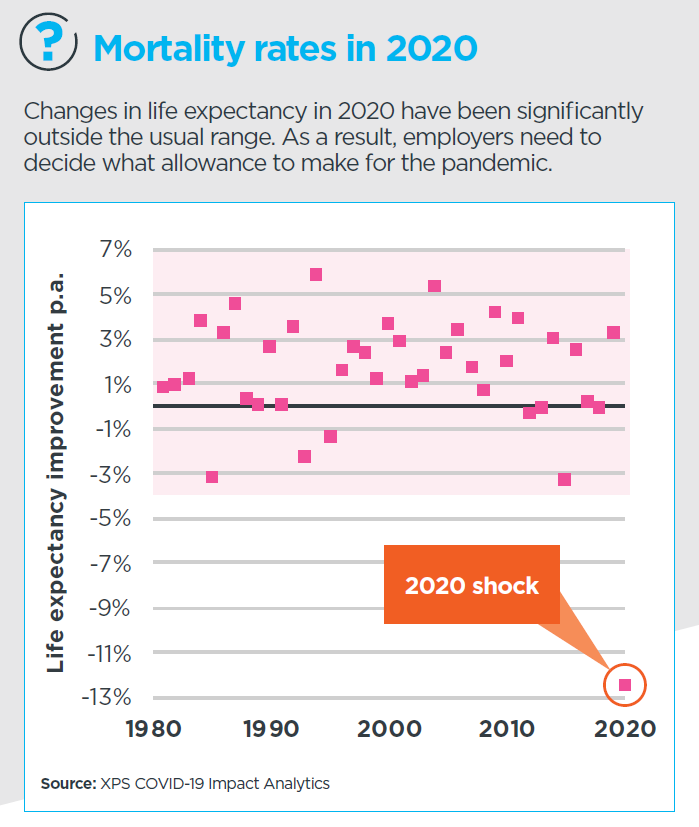

Because COVID-19 made 2020 an exceptional year, the CMI 2020 model requires employers to choose what allowance to make for the pandemic

One option is to ignore deaths in 2020 and even this would still result in a small reduction in life expectancy. However, this is likely to understate both the short and longer term consequences of COVID-19

There is now enough information for employers to consider the positive and negative effects of the pandemic and form a best estimate view for accounting

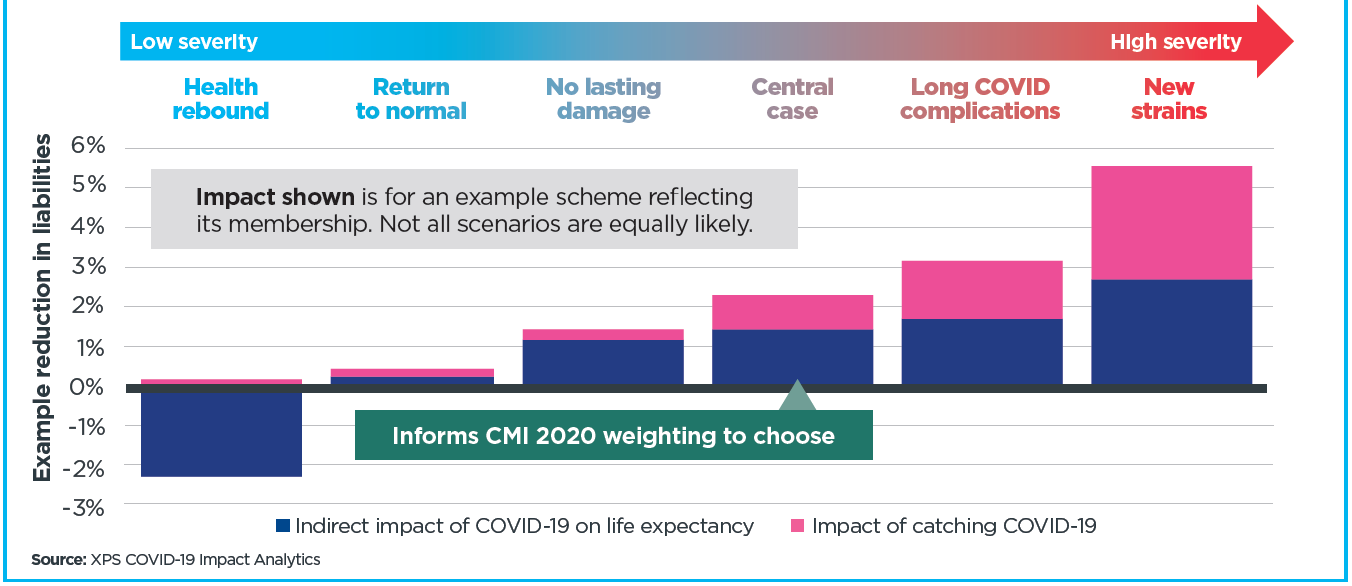

For most schemes, an appropriate pandemic allowance is a reduction of 1.5% to 3.5% in liabilities. For a scheme that is 90% funded, this could mean a 25% reduction in the deficit

Based on experience in 2021 so far, the reductions in life expectancy look set to continue in future CMI models, which supports making some allowance for the pandemic now

Actions employers can take

1. Analyse the impact of COVID-19 on the life expectancy of your scheme’s members.

2. Use this to decide what allowance to make for the pandemic in your accounting numbers.

3. Engage with trustees to extend this to member options and scheme funding assumptions.

4. Consider the impact of the pandemic on your long term target to check whether your strategy needs fine tuning.

COVID-19 scenarios help determine how to use CMI 2020

Our Covid-19 impact analytics considers the range of factors that cause COVID-19 to impact life expectancy.

For further information, please get in touch with Vicky Mullins or Hannah Traylen or speak to your usual XPS Pensions contact.

- Register for events

- Join our mailing list

Register for events

We enjoy hosting a wide range of events for pension scheme trustees, corporate sponsors, independent trustees, and pensions professionals.

Join our mailing list

Keep up to date with our latest news and views including pension briefings, XPS insights, reports and event invitations.