April 2022 - Improving member outcomes. Should you govern or consolidate?

April 2022 - Improving member outcomes. Should you govern or consolidate?

30 Apr 2022

What you need to know

- Following recent consultations on improving benefit outcomes for members in occupational defined contribution (DC) schemes, regulations that have increased governance requirements are now in place.

- All relevant schemes (meaning most occupational DC and hybrid schemes) have increased reporting requirements via their chair’s statement, for scheme years ending on or after 1 October 2021.

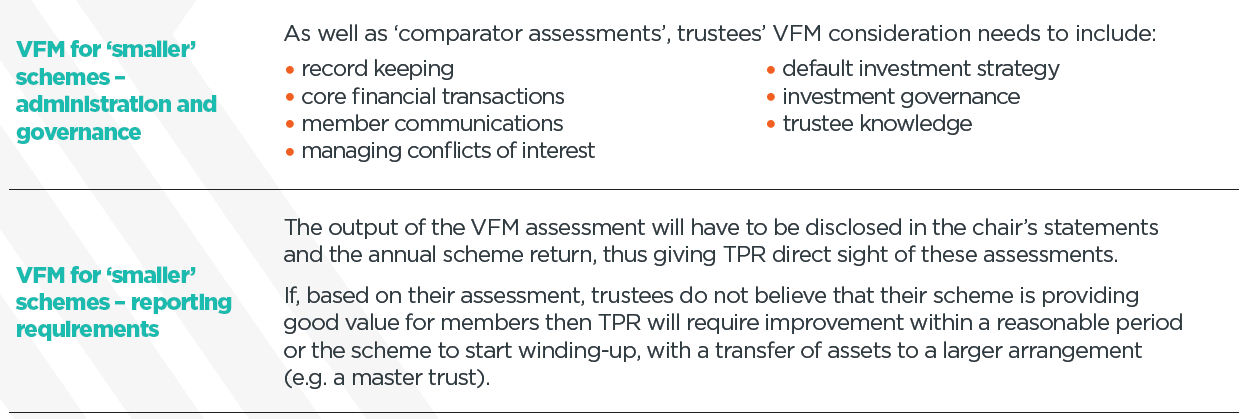

- For scheme years ending on or after 1 January 2022, ’smaller’ schemes (those with less than £100m in assets and having been in operation for at least three years), must undertake a more detailed value for members (VFM) assessment each year. The results must be included in both the annual chair’s statement and the scheme return to The Pensions Regulator, and be published on a publicly available website.

- If a scheme is not delivering good value for members, trustees must confirm in the scheme return whether they plan to wind up the scheme and if not, why not and how they plan to improve it. Any improvements need to be made in a ‘reasonable period’ which is undefined, but it can be assumed this is likely to be before the following year’s assessment.

- For the avoidance of doubt, this does not apply to schemes with only DC AVCs. Yet, trustees already have a fiduciary responsibility and are obliged to govern such benefits in line with codes of practice. All members should be supported to receive good outcomes – and if this is not the case, trustees should improve support or consider consolidating these benefits into a DC scheme that does.

Actions you can take

- Determine whether your scheme sits in the new ‘smaller’ scheme category.

- Review whether your arrangement provides good value for members (regardless of scheme size).

- Consider whether improvements are needed, or consolidation into another scheme (for example a DC master trust) can provide better member outcomes.

The XPS approach

At XPS, we are engaging with trustees and employers ahead of their VFM assessments, to discuss which path they are looking to take; whether to govern or to consolidate.

Doing so, sets the right path for them, rather than waiting for their next assessment, which could mean lost time and opportunities.

Once a path is decided, XPS has the tools to fully support the next phase of either governance (via our VFM assessment tools) or consolidation.

XPS’s survey ‘2022: The Year to Decide’ found that 41% of schemes were looking to consolidate in the next 5 years. 55% were looking to govern (with the remainder largely undecided). We suspect though, that as trustees begin to understand the new VFM assessment requirements, this ratio could change.

The finer detail:

For further information, please get in touch with Christopher Barnes or speak to your usual XPS contact.

- Register for events

- Join our mailing list

Register for events

We enjoy hosting a wide range of events for pension scheme trustees, corporate sponsors, independent trustees, and pensions professionals.

Join our mailing list

Keep up to date with our latest news and views including pension briefings, XPS insights, reports and event invitations.