XPS Pensions Group advises on £650m Mitchells & Butlers buy-in amid busiest period for bulk annuity deals in 2021

XPS Pensions Group advises on £650m Mitchells & Butlers buy-in amid busiest period for bulk annuity deals in 2021

21 Dec 2021

XPS Pensions Group has advised on a £650 million full-scheme buy-in deal between the Mitchells & Butlers Executive Pension Plan and Legal and General Assurance Society Limited, amidst the busiest period for bulk annuity deals in 2021.

XPS acted as lead advisor to the Trustees of the Mitchells & Butlers Executive Pension Plan during the execution of the deal. The Plan’s sponsor, Mitchells & Butler plc, operates a number of the UK’s restaurants, pubs and bars, including Harvester and All Bar One.

Harry Harper, Head of Risk at XPS Pensions Group, said:

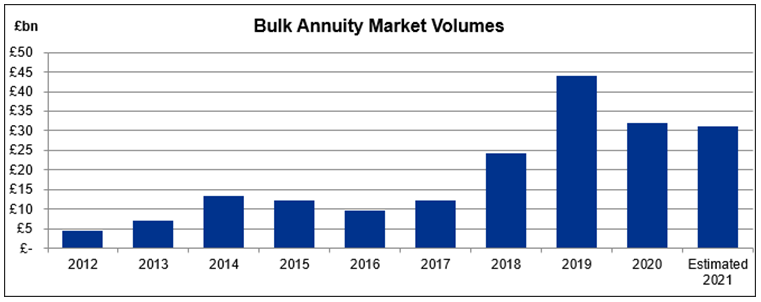

“With hindsight it is clear that the end of 2021 has been the most active period the UK bulk annuity market has ever seen, with at least one insurer telling us the amount of business they have transacted in the last 2 months has exceeded the previous 10 months of the year. 2022 is now looking likely to be an extremely active year for bulk transactions.”The £650m Mitchells and Butlers transaction takes the total volume of UK bulk annuity deals in 2021 up to an estimated £31bn. The total volume of deals for 2021 has been particularly volatile as many transactions have been squeezed into the last few weeks of the year, and some transactions are still in progress and may run over into the first weeks of January. XPS alone has transacted 4 schemes as lead adviser during December 2021."

Jonathan Duck, Chairman of Trustees at the Mitchells & Butlers Executive Pension Plan, said:

“The Trustees are delighted to have concluded this bulk annuity buy-in with Legal & General. The transaction further secures all members’ benefits as well as giving M&B plc, the Plan sponsor, certainty on its future financial commitments. It is a great deal for all parties. I would like to thank the Trustees’ advisors and M&B plc for their steadfast support over the years, which has ultimately made this buy-in possible.”

Related links

- Register for events

- Join our mailing list

Register for events

We enjoy hosting a wide range of events for pension scheme trustees, corporate sponsors, independent trustees, and pensions professionals.

Join our mailing list

Keep up to date with our latest news and views including pension briefings, XPS insights, reports and event invitations.